RevOps, or revenue operations, is a strategy for businesses to align revenue-enhancing teams and activities while improving the customer journey. When discussing RevOps, the emphasis is usually on overcoming silos and having departments such as marketing, sales, and customer service working seamlessly. However, it's equally beneficial from the customer's point of view. The insurance company Lemonade is an instructive case study to illustrate best practices for optimizing the customer experience.

How Lemonade is Disrupting the Insurance Industry

Lemonade is an innovative insurance company, founded in 2015, that offers products such as homeowners, renters, life, and pet insurance. Lemonade has similar services as other insurance companies but has radically changed the customer experience. Here are some features that set Lemonade apart.

- • Strong branding. Lemonade has carved out a distinct niche for itself. Clearly targeted towards tech-savvy younger customers, it promises "Insurance built for the 21st century."

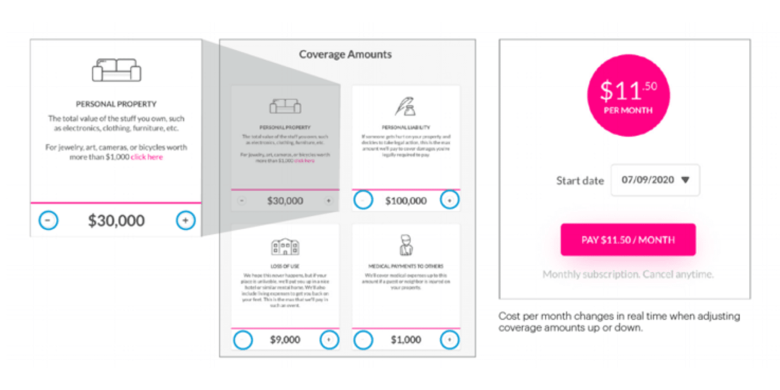

- • Personalized service. One of the qualities that distinguish Lemonade from other insurance companies is the level of personalized service. Maya, the company's chatbot, makes it easy for website visitors to get information and sign up. Maya takes visitors through a questionnaire that guides them to the most appropriate services and provides quick quotes. Another chatbot, named Jim, handles payouts.

- • Flat fee. Pricing is often confusing for insurance customers. Lemonade also appeals to millennials and other younger customers, who tend to have less experience with insurance policies. The company takes a flat fee of 20% from their customers' premiums, which is simple and straightforward. As they point out, their fee structure also eliminates a conflict of interest with customers. The flat rate, combined with their Giveback program (see below), means that Lemonade doesn't lose money by paying claims.

- • Giveback program. When customers sign up for insurance, they choose a nonprofit to support. At the end of the year, any unclaimed money from an account is donated to the nonprofit. Lemonade Giveback provides customers with the satisfaction that they're performing a social good, something that's extremely relevant to millennials. A Deloitte Global Millennial Survey revealed that 42% of millennials would start patronizing a business with a positive impact on society, while 38% would stop supporting a business with a negative impact.

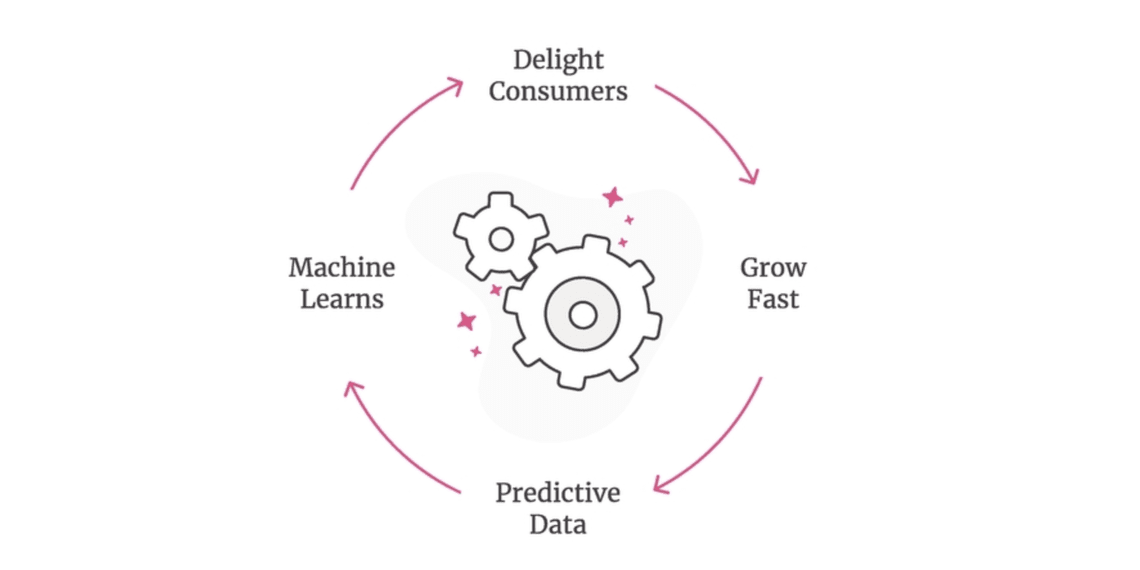

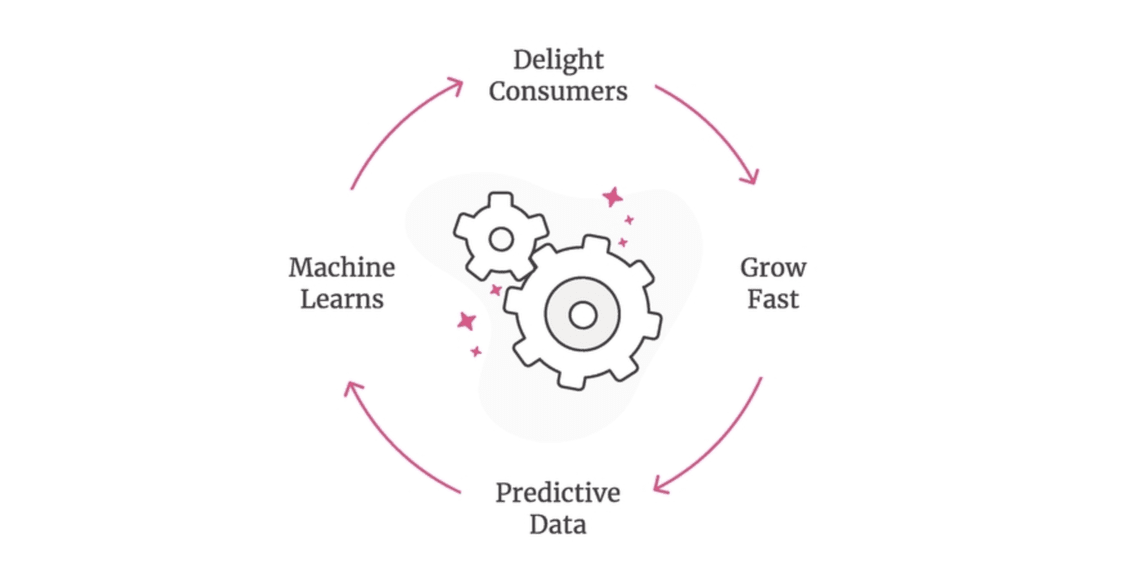

A Data-Driven Approach

Lemonade claims that it collects 100x more data points per customer compared to other companies. In a blog post, Lemonade describes how collecting and studying data are helping to improve its loss ratio. This is the ratio of losses to premiums. As the article explains, a very high loss ratio isn't sustainable for an insurance company, while a very low one is profitable for the business but not good for customers. Lemonade's system of charging a flat rate and donating leftover funds to charity allows it to maintain a stable loss ratio.

One of Lemonade's taglines is to turn insurance "from a necessary evil to a social good." The Giveback program plays a big role in this. But what does this really mean for the average customer? Let's explore if (or how) the customer experience differs with Lemonade when compared to traditional insurance companies.

Do Everything Online

At a time when 73% of millennials prefer to shop online using their phones (the figures are 2x higher for Zoomers, or Generation Z), Lemonade has perfectly tapped into this target market. The traditional process for getting insurance information requires the user to contact an agent, fill out a form, and wait for a quote. With Lemonade, the process is streamlined to be much faster and more convenient. The system's built-in AI (Maya the chatbot) provides personalized service without the user having to talk to a live agent.

What really sets Lemonade's customer service apart is the way it seamlessly transitions customers from one function to another. A new user is presented with information tailored to their buyer persona as they see comparisons of data so they can choose the best service. They can just as easily access claims processing when needed. All of this is automated, without the need to wait on hold or fill out complicated forms.

For a thorough review of the UX advantages of Lemonade's landing page, see A UX Review of Lemonade Insurance in Less Than 5 Minutes.

Image Source: Lemonade

Fast Payments

Another distinctive customer experience feature of Lemonade is guaranteeing fast payments without any paperwork. As with the application process, customers can complete everything online. Claims are approved in seconds.

Easy to Switch

Lemonade targets customers who already have insurance as well as people buying it for the first time. Their "Check Prices and Switch" guides users through the process. As with other tasks on the site, Maya the chatbot guides users through a series of questions to highlight the advantages of switching to Lemonade.

Mobile Apps

Speed and convenience are supported by mobile apps that customers can download. Customers can set up and manage their policies on their mobile devices.

Active on Social Media

Another way Lemonade taps into its millennial customers is by providing news and policy information on social media. Their twitter account is frequently updated. They're also active on Facebook and Instagram. Social posts aren't simply ads for insurance, but links to news items and timely blog posts.

Blog Posts

Lemonade posts stories that are educational and helpful to its audience. For example, a recent post addresses concerns that renters may have about eviction and suggests resources to help. This type of post isn't directly related to Lemonade's services, but it establishes them as a useful source of information.

What Lemonade Has Accomplished

Is Lemonade actually disrupting insurance and stealing customers from more established companies? The Motley Fool, in the article, Can Lemonade Disrupt the Insurance Market? shares some impressive facts.

- • While 50% of renters are under 30, only 37% get renter's insurance. Lemonade is targeting this largely untapped market.

- • Customers who signed up with Lemonade three years ago have increased their spending on renter's insurance by 56%.

- • Between 2017 and 2019, Lemonade increased the number of premiums sold from $9 million to $16 million.

While the article goes on to question whether Lemonade can succeed at converting older and more affluent customers, in our opinion this innovative model will prove to be a clear competitive advantage for Lemonade.

Lessons From Lemonade

Here are some lessons that businesses in any sector can take from Lemonade.

- • Long-standing products and services can be marketed in a new and fresh way.

- • Target specific demographics (e.g. Lemonade targets millennials and renters).

- • Today's customers appreciate speed and efficiency.

- • Provide simple and personalized services. AI tools such as chatbots can help improve the customer experience.

- • Use automation tools to collect and analyze data.