With the continued growth in technology and ever-changing customer values, the investment management industry has witnessed several innovations and disruptors entering the market. While these disruptors have targeted different niches, they all have a few important elements in common — customer experience and personalization. A great example of this would be Wealthsimple, a robo-advisor focused on helping the customer invest in an industry known for taking the wheel.

Wealthsimple is reshaping the investment industry

The financial service industry is no longer just about what you can do for the customer but what you can help the customer do. Wealthsimple has improved upon traditional ideologies to cater to consumers who prefer to have more hands-on experience with their finances.

Some of their most noteworthy components include:

- • Easy to understand pricing — pricing and plans are straightforward, so customers know the exact cost: a 0.5% fee in Basic, .4% fee in Black, and .4% fee in Generation, etc.

- • No minimum investment amount — no minimum investments allow more customers to invest what and when they feel comfortable instead of feeling pressured to meet requirements.

- • Risk assessments — while many companies may offer risk assessments, Wealthsimple also offers free evaluations with experts on what those assessments mean.

- • A millennial-friendly approach — with the average age to start investing reaching 39% of adults in their 20s and more than a quarter of adults in their 30s (only 15% 40s and 6% 50s), Wealthsimple stands out significantly for catering to millennials and younger. This is done through digital tools that make the process easier, several sources of brand/consumer communication, sustainable options, and more.

Wealthsimple's unique strategy

According to Wealthsimple, investment doesn't have to be difficult, and they have broken it down to the fundamentals in their strategy to prove it, making the process much easier for their clients. Their investment strategy involves the 3 following elements:

- Diversification — profiles are diversified within an asset class and across assets.

- Passive Management — history and research have shown this strategy is the most sound.

- You're The Boss — everything is customized specifically to the customer with an expert's help and guidance.

Appeals to every customer journey touchpoint

While we're on the topic of customer experience, it's also important to note the value of personalizing your product so that it fits consumers in all stages of their customer journey. For Wealthsimple, this is evident in their 'accounts that fit your goals' section, which is dedicated to finding the right account for each consumer. The intuitive onboarding and portfolio selection tool, in particular, provides a simple way for users to become clients, especially millennials.

Another great example of this same personalized customer journey approach is Ellevest. This is another financial service firm inspired by the importance of customer journey — only they went a little further and implemented goal-based customer journeys in the signup process: build wealth, retirement on my terms, a once-in-a-lifetime splurge, a place to call home, kids are awesome, and start my own business.

The user experience of Wealthsimple versus traditional financial advisors

Wealthsimple is known for its special attention to customer experience and personalization. The following ways emphasize how that sets them apart from traditional financial advisory firms.

Diverse portfolio options

While all providers offer the traditional taxable accounts and IRA account, etc., Wealthsimple goes another notch higher and not only offers more accounts, but also gives customers access to socially responsible and halal-compliant options. This is a huge deal because research shows that 77% of consumers say sustainability is important to them.

In fact, Wealthsimple has a comprehensive list of accounts you can open. They offer links to each account for more in-depth information to keep customers informed on exactly what they're getting into:

- Registered retirement savings plan (RRSP)

- Spousal registered retirement savings plan (RRSP)

- Tax-free savings account (TFSA)

- Non-Registered (personal/joint account)

- Wealthsimple Save (savings account)

- Registered Education Savings Plan (RESP)

- Registered Retirement Income Fund (RRIF)

- Locked In Retirement Account (LIRA)

- Life Income Fund (LIF)

- Corporate Investment

The wealth 'simple' experience

There's no coincidence the word simple is in the title. Wealthsimple prides itself on delivering a beginner-friendly user experience that is simple, straightforward, and easy to navigate. Even better, any questions their clients may have about how an investment works can be quickly answered through their help center page, robo-advisor, and/or human financial advisors.

This experience is different from traditional investment management firms because it adds convenience and choice to the customer's experience by having more than one way to seek an answer.

Continued investing education

Between their blogs/articles (under "personal finance 101"), detailed help center, magazine, and investing master class, their clients have the full investing expertise and experience consumers crave today — all at their fingertips without going out of their way to meet in person. This digital education allows users to fully benefit from investing without the confusion of jargon, mysterious strategies, and more.

In fact, they even divide up categories for quick access on topics specific to the user: investing, saving, taxes, homebuying, crypto, accounts, finance, retirement, and more.

This kind of simple and customized experience empowers their customers to not only trust them with their money but enjoy a more hands-on customer experience in the art of investing, saving, and overall financial well being.

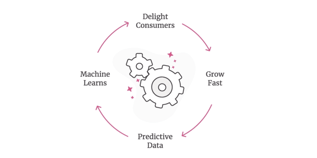

Every industry can take a page out of Wealthsimple's book

Customer experience and personalization aren't only important in the financial sector. In fact, it is essential to all industries and businesses. Customers are becoming more accustomed to relevant and consistent encounters with brands — and before you know it, they'll demand it. A RevOps strategy gives the customers what they've been asking for by unifying your teams and optimizing consumer experiences.

After all, it was Wealthsimple's customer-centric approach to fintech that has led to its rapid growth since 2014 — earning more than $5 billion in assets under management and managing money for more than 175,000 people.