Table of contents

Just a few years ago, selling financial products or services was a matter of human interaction. In fact, it's what the customers expected and demanded. The marketing team produced enticing images and copy. Sales representatives were expected to meet prospects face-to-face and cater directly to their needs in an act of friendly persuasion. A customer might come in to open a banking account and discuss its features, apply for a credit card, or investment account, or buy insurance. Customer service entered the picture after the sale to support the customer and resolve any complaints. But times have changed. Revenue Operations (RevOps) is the way to succeed in today's sales and marketing landscape.

From Sales Reps to RevOps

As we move further and further from the bright old days of the pre-pandemic era, we are witnessing an acceleration to digital transformation of not only the technology of consumption but also how consumers consume. Ask a person 10 years ago what a good buying experience is and they might have described a scene where a bank representative talked to them for an hour and they came away with the perfect insurance package. Ask a person today about the ideal buying process and they'll describe an app or website that fully automates and streamlines their search, persuasion, and purchase.

Stats on Independent Client Trends

Right now 33% of modern buyers prefer a completely seller-free sales experience, and 44% of millennials would rather buy without interaction. In fact, most prospects have already decided through research whether to buy before talking to a salesperson and aren't in the market to be persuaded. This calls for a whole new approach to marketing, sales, and customer service.

Revenue Operations for the Modern Customer Base

RevOps (revenue operations) is the method of embracing the latest in commerce technology and how it has reshaped the expectations of both B2C and B2B customers. Instead of having only the isolated work of marketing, sales, and customer service, RevOps proposes a unified effort between them: enhancing revenue through customer experience and satisfaction.

Transforming MQLs and SQLs into the Conversion Journey

Why synchronize the operations of three departments into one? The answer arises from the errors found in the MQL and SQL system of lead qualification. Marketing draws in leads and their data theoretically qualifies those leads for sales to take over. Back in the days of personal sales experiences, this made sense because 'sales' was the main event. Now, customers sell to themselves, and defining a 'qualified' lead is trickier than ever.

Today, sales often complain that marketing sends not-so-qualified leads, or marketing feels that sales are wasting the leads they send. Neither is satisfied and, worse, customers are being lost in the cracks. Customers who are quiet and non-self-qualifying lose the guiding benefit of the sales model while customers who share information but are slow in decision-making frustrate the lead conversion model.

RevOps embrace the new reality that marketing, sales, and even customer service are now wrapped into one online experience that can be streamlined with design and quantified with analytics.

RevOps as a Goal, Not a Singular Method

When approaching the concept of RevOps strategies, it's important to see that RevOps is an evolving philosophy taking form as a strategic action, not a 'one right way' method of improving revenue or customer satisfaction.

There are several active and effective strategies being used by companies implementing the RevOps approach. Some have formed new teams or RevOps departments. Some focus primarily on the data and website streamlining, some unify their strategies using existing tools to make the experience more complete for customers.

Which of the RevOps strategies you choose and how it is implemented should be determined by your business model, customer needs, and the teams and resources that provide value to customers.

The Unity of Data Strategy

For most, RevOps starts with a unification of customer experience data. As data and analytics grew into the old lead-qualifying model, marketing, sales, and post-purchase customer service wound up with separate tools, analytics, and data silos. These silos, by not working together, created three profound problems.

The first was data isolation: The individual teams working with customers did not know about the useful data being gathered for the separate 'marketing,' 'sales,' and 'support' purposes and so their improvement scope was limited.

The second problem was data duplication and/or swivel-chair data transfer. This meant teams that did know they needed the same data either collected it twice (sometimes to the chagrin of customers) or had to manually take data from one department's systems to another's.

The third was an inconsistent customer experience. Customers today expect - with all the data flying around - that Sales will fulfill the promises of Marketing and that Customer Service will know of their recent sales experience. When this isn't true, customer experience, and therefore revenue, both suffer.

So the first strategy is a unification of data through robust enterprise software, centralized data storage, and sound data governance policies that that can maintain data integrity and consistency between the three traditionally separate departments.

The RevOps Unity of Purpose Strategy

The unity of purpose strategy compels RevOps teams (unified or multi-department) to work together to create a single, smooth customer experience - however, that may be achieved internally.

Consider how important it is that messages sent by marketing are mirrored in the buying experience. Consider how vital it is that customer service is aware of the customer's entire conversion journey - and where that journey stops when they ask for help. Unity of purpose makes the goal to streamline customers' experience and ensure that the automated and personal guidance they receive is perfectly in line with customer expectations.

This all results in smoothly enabling new conversions and sales, complete with a customer's ability to change their place in the conversion funnel (from prospect to lead to assistance-seeking) at any moment based on their own motivations and personal conversion path. When the teams work together or form a single team with a unified purpose of RevOps, the gaps between MQL, SQL, and SAL disappear to only acknowledge customers in their current journey toward conversion or bounce.

The RevOps Maturity Curve

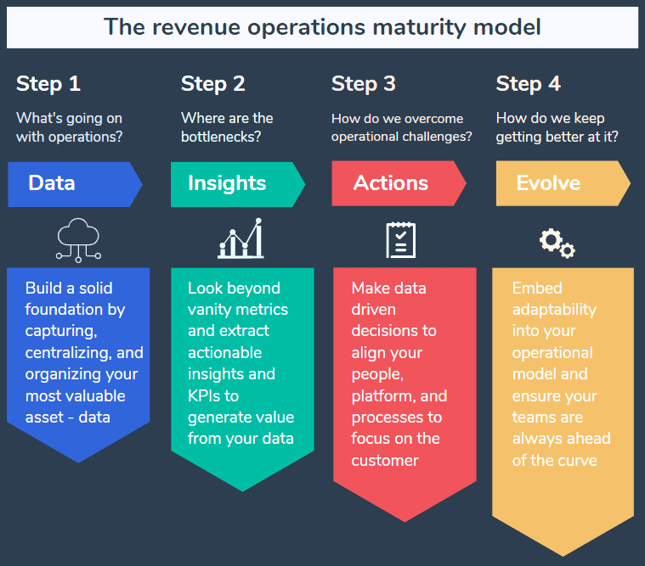

Learners.ai's RevOps Maturity Model approaches a firm's RevOps strategy with a simple step-by-step assessment of organizational capabilities and readiness.

In the first step of the maturity curve, a business assesses all the data between the three departments and assesses what they know of the customer experience. The first step often involves a software unification of data capturing, organization, and automation.

The second step of RevOps maturity is analyzing the entire buyer experience from beginning to end. What do buyers experience from marketing to sales to mid-shopping and post-purchase customer service? Identify both the good and bad of this experience, what makes it easier for customers and the gaps that might increase challenge or frustration. In other words, determine the current customer experience and your goals for improvement.

The third step is your action plan. Determine with data-driven conclusions the best course of action to unify how customers are handled and improve your customer experience. This gives you the opportunity to form a plan for big-picture improvements and to address specific pain points.

The fourth and final step of the RevOps maturity strategy is to assess the first cycle's success and optimize your methods.

The Automation and Buyer-Engagement Model

Finally, there is the ultimate goal of automation and buyer-led engagement. Today's consumer is an independent shopper who is used to doing their own research, finding the products they want, and reaching their own conclusion to buy. This makes the website and mobile app your ideal venues and hyper-personalized automation an ideal approach to a unified and seamless customer experience.

The ultimate goal should be to create a self-driven customer experience model, also known as buyer-led engagement. Here, the buyer decides where they are in the conversion funnel along with the tools they care to use and, if anyone, the sales reps they want to work with. The more automated and personalized the experience, the happier the customers.

Quantifying Missed Opportunities

Did you know that 70% of buyers fully define their own needs before engaging with a sales rep? 44% research and choose the solutions they want before reaching out to a seller at all. In fact, clients are now happier when they can make a solo decision and then choose their provider. But most financial services firms are missing out.

Right now, the financial industry has only half-embraced automated self-conversion tools. 70% of retail banking brands with product comparison don't let their users choose which products compare. Less than half of insurance and wealth management brands allow users to filter their product search by any criteria other than location. While financial calculators are available for loan financing, only 30% of financial sites have calculators for payments or savings and fewer than 16% have calculators for budgeting or rates.

These are missed opportunities to help your clients explore their options and make their own decisions.

Are you Ready to Implement a RevOps Strategy?

RevOps is not a single strategy that works or doesn't; it's a new way of approaching customer experience and revenue optimization. Your business's RevOps strategy should be built on a foundation of unified data and streamlined revenue generation, but each implementation will be unique.

Get started with our RevOps Checklist or assess your current progress with our Free RevOps Grader tool to find where you stand in the maturity curve. We also welcome you to book a consultation with our RevOps experts to explore and refine your current RevOps strategies and success.