In the traditionally relationship-driven field of financial services, Artificial Intelligence (AI) was until recently seen as a frightening development, with conventional wisdom assuming that customers would never trust their financial futures to a machine.

These days, the entire industry is reliant on AI for customer engagement and service, with a 2021 NVIDIA study finding some 83% of professionals in the field “agreeing that AI is important to their company’s future success.”

With customers increasingly comfortable interacting with AI-powered tools such as conversational interfaces, it is clear that the future of service within the industry is going to continue to evolve, with an ever-shifting balance between human and AI engagement necessary for meeting the needs of both consumer and business going forward.

All of which raises a number of questions for firms, not the least of which is how individual companies can embrace this ever-shifting paradigm with an eye on driving results now and in the future. To fully answer this, it is necessary to look both to the tech stack and beyond, to the company’s understanding of the nature of customer service, and the needs of individual customers. While this is a daunting task, choosing the right approach, coupled with the appropriate tools and partnerships, can bring a bold, transformative vision to life for any company in the industry.

The Business Case for Better

Customer Service in Finance

For much of the 20th century, “customer satisfaction” and “finance” typically only belonged in the same sentence for corporate and high-net worth clients. The majority of smaller-dollar clients tended to conduct the majority of their transactions with local institutions and, with few options for them to switch providers, coupled with a high degree of inconvenience, improving customer experience simply wasn’t a focus for many. For those larger-dollar clients, meanwhile, institutions tended to rely on a mixture of results and relationships to ensure that their best customers remained within the fold.

Even with the advent of online services, many financial institutions were slow to improve their digital offerings and customer service. As a result, many are still struggling to effectively harness the power of data to inform and improve everything from prospecting and customer journeys to upselling and client retention opportunities.

Several key facts bear this out, while also pointing to a brighter digital future for the industry—with the coronavirus pandemic emerging as an unlikely driver of positive change in customer service focus across the industry.

Consider that:

- • In 2019, some 82% of U.S. households had an Amazon Prime account—an indicator of how widespread commerce has become.

- • In the same year, digital-only customers were “just 30% of the retail bank customer base, which routinely had the lowest level of customer satisfaction of any channel,” according to J.D. Power.

- • By 2021, that had risen to 41%, accompanied with a significant increase in customer satisfaction—a fact attributed to satisfaction improving “most among customers who have high levels of digital engagement with banking products and customer service.”

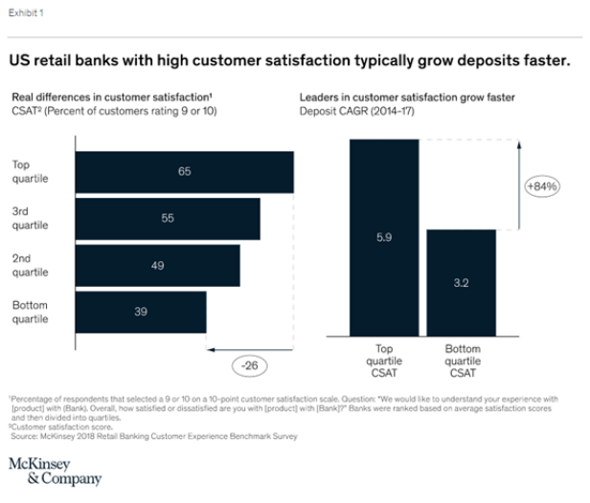

- • Banks with the highest degree of reported customer satisfaction see deposits grow 84% faster than banks with the lowest ratings, according to a survey by global management consulting firm McKinsey & Company.

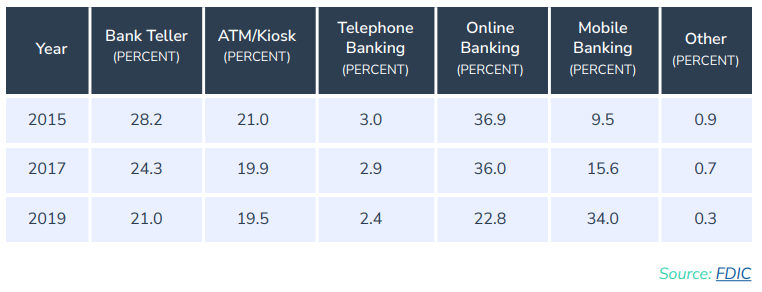

- • Just 56.7% of retail bank customers were using a bank’s website or mobile offering as their primary means of accessing their account in 2019—up from 46.4% in 2015, according to FDIC data.

- • That rapid growth suggests we may be nearing a tipping point, particularly with mobile site or app adoption, which grew from being the primary choice of just 9.5% of consumers in 2015, to 34% in 2019.

- • During that same period, primary preference for ATM or teller-based banking declined by 10 points.

Taken together, these facts clearly indicate that digital services and interactions with consumers are not only the future of the industry—but key to unlocking customer satisfaction and retaining business. As such, the coronavirus pandemic can be seen as something of a force multiplier for this digital transition, with consumers adopting digital-first banking out of necessity, rather than merely by choice.

All of this presents a significant opportunity for financial institutions to collect more data than ever before about customers. But in an environment where digital-only upstarts are beginning to divert market share away from traditional competitors, simply gathering this information is not enough: Institutions must learn to leverage it for retention, upsell, and cross-selling opportunities.

Deposit Displacement

Case in point: As barriers to entry come down for consumers, account or provider switching does not appear to be accelerating—at least, not if financial services providers are looking at

closed accounts.

Writing in Forbes in 2019, Ron Shevlin, Managing Director of Fintech Research at Cornerstone Advisors, noted that consumers rarely take the time to close out accounts, even when they’re unhappy with service. Instead, they simply open new accounts, using existing accounts as “paycheck motels” to temporarily house their money before dispersing it to other locations—a phenomenon Shevlin dubs “deposit displacement.”

Among the beneficiaries of this type of displacement: other banks, savings accounts,

credit card providers, P2P payment apps, investment apps, and more.

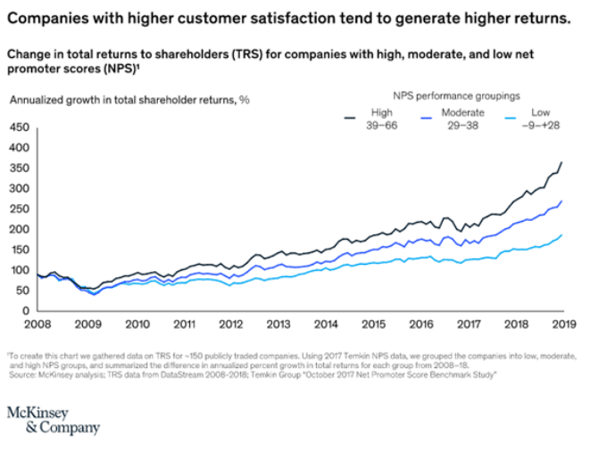

Further McKinsey & Company research, meanwhile, indicates that providing better customer service may lead directly to higher deposits, as well as better returns.

How HubSpot’s Flywheel Applies to Financial Services

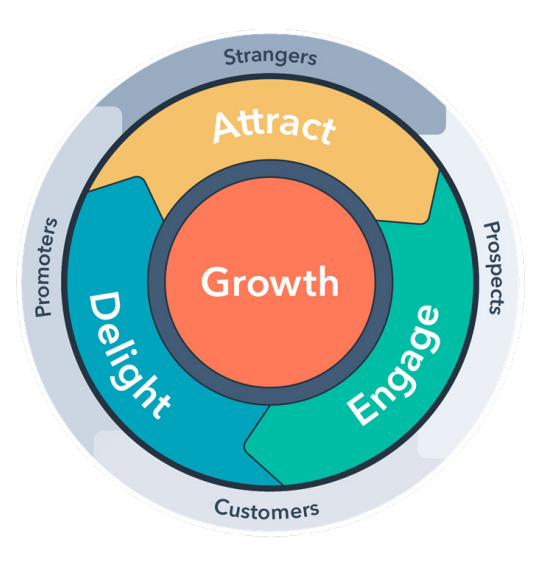

As we have seen, there is a clear feedback loop in financial services between customer service, customer satisfaction, and business growth. In any other business, this would not be seen as a remarkable proposition—as evidenced by inbound marketing, sales enablement and customer service platform HubSpot’s “Flywheel”—one of the best-known framings of this virtuous cycle.

As can be seen in this model, growth does not begin or end with the acquisition of new contacts, or when they are converted to leads, or even customers. Instead, as HubSpot notes: “With the flywheel, you use the momentum of your happy customers to drive referrals and repeat sales. Basically, your business keeps spinning.” This works just as well in financial services as it does in any other customer-centric business.

Why Is Customer Engagement So Difficult to Achieve?

While the approach to driving better results through customer satisfaction seems intuitive—as in the HubSpot model presented above—there are several factors that tend to hold financial services outfits back from being able to fully “flywheel-ize” their businesses. These include:

Case Studies:

How the Flywheel Methodology Impacts Financial Companies’ Bottom Lines

By following the principles of attract-engage-delight, the following financial services companies have all seen improvements in customer engagement, as well as to their bottom lines.

AES International Increases Leads by 7.5X

- •“We have really seen a turnaround. Website traffic has increased by 10X, from 1,500 visitors a month to 15,000. Our blog is particularly popular. Pre-2014, we got about 200 hits a month; last month, we got 5,651 views, a 28X increase. Our leads are up by 7.5X. Before partnering with HubSpot, we got an average of 20 a month—now we’re averaging 150.”

- •“Our industry is well known for using outbound techniques; it’s about a decade behind the rest of the world. They are all used to cold calling, flyers and events. But our marketing team has always been aware of the power of inbound, we just had to find a better way to do it.”

- •“When we realised what we could do—automate so many of our tasks and have everything in one place—we really didn’t need to look elsewhere. The HubSpot interface is really easy to use, it solved all the problems we had and created new opportunities for our small team. We were completely convinced."

Katapult Earns Consistent 4.4-Star Customer Reviews

- •“When you combine customer service and marketing on the same platform, you can be more proactive.”

- •“When marketing and service are working hand-in-hand, you’re not having separate conversations with the customer. You can have one conversation that takes them end-to-end through your process.“

- •“Customer expectations increase every day, and they choose to interact with companies that do it really well, especially in B2C. The bar is high—and you have to be able to meet and exceed it.”

F1F9 Revolutionises Its Lead Generation Process

- • “It’s revolutionised our marketing. We now have a much more professional and strategic approach that’s generating leads and sales. HubSpot has helped us rapidly grow and scale our business.”

- • “Landing Pages revolutionised how we use our content. Before we implemented the HubSpot software, it would have taken at least a month. Now we could do it within a few hours.”

- • Our senior team “couldn’t be happier” with the gains F1F9 has achieved since partnering with HubSpot. Within three months the results were spectacular. “Before, we were a small company in a niche industry, so we were getting small levels of traffic. With the HubSpot software and inbound marketing methodology we were doubling our web traffic every month and that carried on for a sustained period. We went from 2,000 visitors to 5,000, to 12,000, and it has kept on growing.”

How to Harness AI for

Customer Engagement

One major use case for AI in Customer Engagement is its ability to offer real-time personalization, particularly in providing individually tailored offers to prospects and existing clients at exactly the right moment.

The key to harnessing this potential: data. Any AI is only as good as the data it relies on. With enough data on customer journeys—including touchpoints across both the digital and physical realms—AI-powered solutions can help to revolutionize both offerings and outreach, creating solutions and experiences that both engage and delight consumers.

Potential offerings include:

Tailored Consumer Advice

For many consumers, financial planning and management are sources of stress and frustration. With an appropriate AI solution, financial institutions can help to alleviate these worries by learning from consumer habits to provide tools for budgeting and planning for major events, warning consumers when their spending starts to veer off course, and even suggesting products or services that are better fits for their specific needs.

Convenient Compliance

By leveraging machine learning, financial institutions can perform compliance-related tasks such as verifying identity without having to make a customer visit a branch or jump through hoops. Tools that can verify identity from a passport or driving license not only cut down on time and administrative burden for financial institutions, but also help to reduce frustration and improve satisfaction for the consumer.

Machine learning can also be leveraged to monitor consumer accounts for unusual behavior and provide real-time fraud detection.

How to Choose a Customer Service and Engagement Partner

As we have seen, customer service and engagement are not optional extras in financial services—but core pillars for a holistic growth strategy. As such, choosing a partner to help place service and engagement at the heart of your business is a critical business decision. Here are a few success factors to weigh in any potential partner:

- Industry knowledge - In a sector with knowledgeable, highly specialized buyers, and a range of product types not found in any other industry, a partner that knows the terrain is a must.

- Customer knowledge - It is vital that your partner understands customer needs and expectations. A strong partner will be able to assist on everything from tailoring product recommendations to message personalization, unlocking additional value long beyond the initial customer onboarding process.

- Compliance - Put simply, there is no room for any partner to learn about regulatory and reporting requirements within financial services on the job. Simple mistakes can have devastating financial consequences, making a seasoned industry partner a must.

- Educational ability - Every customer journey has touchpoints that require teaching a prospect about aspects of their role, potential solutions, and more. A partner with a background in communicating with and educating consumers will be a strong asset.