The Challenges Facing

Financial Services Sales Teams

In the world of financial services, “sales” is a very complicated concept--a fact that stems directly from the often complex nature of the products and services being offered, as well as stringent regulatory requirements, and the need to gain buy-in from multiple stakeholders on any given deal.

With all of this in mind, it should come as no surprise that one-size-fits-all content offers and out-of-the-box sales messaging and strategy is nowhere near enough to meet your organization’s needs in the modern era of selling financial services. What’s required is a modern, streamlined approach to sales enablement that harnesses technology to create and support cross-functional alignment between sales, marketing and operations with the sole purpose of making the entire sales process more efficient.

Across the broad spectrum of financial services, from investment management to insurance, sales teams are facing a variety of challenges, including:

- Informed Buyers

Increasingly a reliance on time-tested, traditional sales practices within the financial services industry is giving way to techniques that are common in other sectors, including inbound marketing and sales, and a focus on providing a personalized experience at scale. As in many industries, buyers are better informed about products, services and performance than ever before--a fact that has been accompanied by a rise in customer expectations throughout the sales cycle and beyond.-

Lack of Support for All Sellers

Whether RIAs in investment management or Agents in the insurance industry, independent advisors can also operate as sellers, and yet frequently these professionals are not considered to be part of the sales team. As a result, they can be overlooked when it comes to access to critical sales messaging and content, creating both communication difficulties and lost sales opportunities.

- Regulation = Content Headaches

- Managing sales-focused content in an industry with strict regulatory and reporting requirements is a major pain point that often results in sales outreach only including the most generic information. However, with 95% of buying decisions being directly influenced by content, and 82% of buyers viewing at least 5 pieces before committing to a purchase, the importance of strong content that speaks directly to the buyer’s needs has never been more obvious.

- Blurred Lines

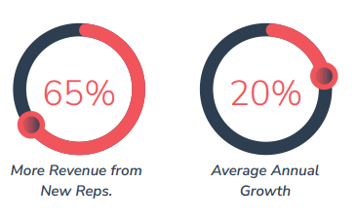

Many financial advisors manage clients with both personal and business accounts under the same broad portfolio. As a result, lines between B2C and B2B messaging can get blurred, leading to problems with managing communication and making the appropriate recommendations at the right time for specific clients. - The solution to all of the problems above is not simple, but neither is it impossible. Dedicated Sales Enablement support helps companies to streamline their operations, know their customer better, and deliver the perfect piece of content at exactly the right time. Indeed, teams that get it right have seen up to 65% more revenue from new reps, and 20% average annual growth as a direct result of creating full alignment across their organizations.

Learning a

Better Way Forward

To compete in the high-touch, personalized sales arena of today, financial services providers must learn to focus on the customer experience, from the first touch point to maintaining contact post-sale. This revolves around a number of core ideas:

How to Build an

Effective Sales Enablement Plan

Putting everything together, it should be clear by now that there is more to sales enablement than simply coming up with a few new email sequences and collateral pieces.

A good sales enablement plan will have all four of the following elements:

- Processes - Repeatable sales enablement workflows that allow your team to scale their outreach and communication while taking much (if not all) of the manual labor out of everything from setting appointments and sending reminders to tracking interactions and follow-ups.

- Platform - A forward-thinking sales enablement process needs the right tools for tracking and measuring your revenue operations.

- People - Breaking teams out of silos is one of the most important steps in ensuring that your plan can function effectively. Individuals across sales, marketing, legal, compliance, finance and customer service must be able to think holistically, supported by tools that help them collaborate between departments.

- Training - A key component of improving your performance, training programs should be relevant, regular, and focused on just-in-time delivery. As such, searchable internal knowledge bases and libraries of updated sales material are more likely to produce positive results than annual training requirements that are typically met with resistance.

How to Choose a Sales Enablement Partner

Choosing a partner to help with sales enablement is a decision that can make or break your business. Here are a few success factors to weigh in any potential partner:

- Industry knowledge - It is vital that your partner not only understands business processes, but how those processes pertain specifically to the financial services industry. In a sector with knowledgeable, highly specialized buyers, and a range of product types not found in any other industry, a partner that knows the terrain is a must.

- Customer knowledge - A strong partner will be able to assist on everything from persona development to personalization of messaging, and bring value to the table at every stage of the buyer’s journey.

Compliance - Put simply, there is no room for any partner to learn about regulatory and reporting requirements within financial services on the job. Simple mistakes can have devastating financial consequences, making a seasoned industry partner a must.

Sales-focused training - Sales enablement doesn’t end when your new system has been established: it requires ongoing training and resources to ensure that everyone on your team is comfortable with the new processes, and knows where to find answers when they run into an issue. A partner with a background in upskilling sales teams on an ongoing basis will be a major contributor to your ongoing success.

.png?width=714&name=What%20Sales%20Enablement%20is%20NOT%20(1).png)