Table of contents

Financial health is as important as physical and mental health, if not more. And yet, despite how central financial services businesses are in our lives, many people don't realize that these businesses also focus on sales. People don't just choose a service provider to work with; they have to be drawn in and convinced to become customers.

For that reason, your financial services sales teams have to work hard to make your organization stand out, target the right audience, and convince people to buy products and services when they are ready for them.

For many years, sales teams in financial services relied on instinct; they used relationships and human emotions of fear and greed rather than facts and numbers to guide their sales processes. However, thanks to technological advancements and availability of data, today's financial services sales teams can rely on several tools to infuse a data-driven sales approach. Here's why and how.

Why and how is the sales process becoming more data-driven for financial services?

Financial services is a sector in which customers interact with a business in various ways every day. They can access a company's app, browse the website, open a newsletter, contact their point person, and do much more, all within a short time. Because of the diverse interactions between customers and financial services businesses, there is a LOT of data your teams can gather and analyze.

Most firms now realize there is a lot of power in that data if they can analyze it and extract actionable insights. Sales teams use CRM software to collect customer data and then analyze it for meaning. With software that can make sense of all those numbers, your marketing, sales, and customer service teams can better understand what customers want and need, and how they like to interact with your business.

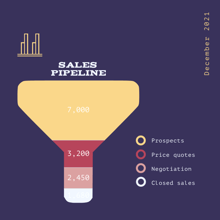

This can help you optimize how you market, sell, and communicate — targeting your audience to make them want to buy. Data can also help you increase pipeline velocity, which decreases the cost of each qualified lead and allows you to invest more money in other aspects of your business.

How can data and analytics help drive customer loyalty for revenue growth?

With intelligent tools making robust, actionable conclusions from large datasets, your sales teams can use the data they have at their fingertips to better understand customer behaviors. This can help them know how and when to target leads and keep current customers from jumping ship. Data can even let you predict customer attrition. When there are signs that a customer is pulling away, you can take active steps to improve the customer experience, make them happy, and pull them back.

Additionally, data can help you select the "next best purchase" for current customers. You can choose the next product or service a customer is most likely to buy and offer it to them before they even realize they need to buy it. Not only can you keep customers purchasing from you without having to do much work, but you can make current customers feel understood and valued—boosting their positive associations and increasing the loyalty they feel toward your company.

The key elements of a data-driven sales strategy for financial services

Financial services firms seeking to extract more value out of their data to increase sales should embrace these key elements:

-

• An openness to data: Your organization should embrace data as powerful and helpful. Rather than discounting sales team knowledge, pair it with insights gleaned from data to develop an incredibly powerful sales process.

-

• Data collection and analysis tools: Use tools like the HubSpot CRM that collects and centralizes data to make sure you have a single source of truth for your customer data. Gathering the data — and ensuring it's accurate — is the first step toward analyzing it. Analytical tools can either be part of the CRM or sit on top of it to come up with meaningful insights.

-

• Data-based goals and data-backed decisions: Allow historical data to help you set goals. Use insights from the data to help you make decisions. Do this across the organization, so your marketing, sales, and customer service processes work in step and collaborate to bring in new customers, convince them to buy, and keep them happy.

Learn more about data-driven sales for financial service

Consider the following articles to learn more about how you can use data for sales enablement and sales forecasting.

-

• Harnessing Data Analytics in Financial Services to Drive Customer Loyalty

-

If your financial services business is ready to use the power of data to grow, reach out to Learners.ai today. We can help you extract more value and glean actionable insights from your CRM data, make better decisions about your sales process, and close more deals with sales intelligence. Contact us today to learn more about how we can help your particular business goals.