Table of contents

The process of selling for sales teams in financial services is a challenging and involved one. Due to the nature of the products and services offered by these firms, it's also often a longer process than other industries. Not only do sales team members need to identify leads, nurture potential buyers, and close deals, but they also need to rely on data to help them guide their efforts.

One of the best ways that sales team members can optimize their efforts and speed up the process as much as possible is by looking at historical and current data to help them guide their decision-making. However, it can be overwhelming and time-consuming to find and gather the relevant data. For all these reasons, sales intelligence is becoming increasingly important to apply a data-driven approach to sales for financial services firms. Read on to learn more about what sales intelligence is, how it can help with systematic selling, and how it can be used for sales enablement in the financial services industry.

What is sales intelligence and why is it important?

Sales intelligence refers to the collection and analysis of sales data and the usage of the insights you come up with from that analysis. Sales intelligence helps you better understand the behavior of your leads and customers, so you can amend your sales efforts to optimize close rates and accelerate revenue. Rather than having to wait until marketing campaigns or sales pushes are complete to understand the effectiveness of efforts, sales intelligence gives you insight into customer behavior before you market or sell to them, and helps guide sales forecasting, so you can increase the chances of success right out of the gate.

Today, sales intelligence is easier than ever, thanks to modern Customer Relationship Management (CRM) systems. For example, the Hubspot CRM has the ability to act as a "single source of truth" for all your customer data, whether it is related to marketing, sales, or customer service. This makes it possible for people to make sense of huge sets of scattered data, and then to glean actionable insights from that information.

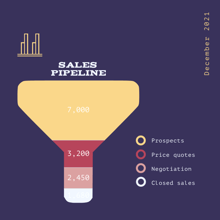

Sales intelligence is important because it allows you to maximize sales efforts, in terms of effectiveness and speed, and it can help you increase your pipeline velocity. Sales intelligence ensures you don't waste your time selling to people who won't buy; that you don't target the wrong audience of leads; and that you don't ramp up sales efforts at a time when people aren't going to purchase. It helps you hone and refine the efforts you use to bring in prospects, then helps ensure that you close deals with those prospects as quickly and painlessly as possible.

Without sales intelligence, sales can be a guessing game based solely on the intuition of individual sales team members, and while your sales folks are experts and their intuition can help real, hard data gives you factual insights into the best way to operate sales.

Ultimately, effectively utilizing sales intelligence means you can generate more revenue, invest more in sales and marketing efforts, and in turn, help your business to thrive and grow.

How can sales or consumer intelligence accelerate revenue in financial services?

Sales intelligence is helpful in a variety of fields, but it can be extremely helpful for sales teams in financial services. When you use sales intelligence in the selling process, you can make more strategic and tactical decisions on how to target and nurture your leads and prospects, and ultimately close more deals.

If you want to get better at utilizing sales intelligence for financial products and services, utilize tools that collect data from all your customer lifecycle touchpoints and analytics that mine that data for meaningful insights. Artificial Intelligence can help you to personalize sales efforts, hyper-segment your audience, better cross- or up-sell, reduce churn, and improve overall customer experiences.

When you have a better sense of who wants to work with you, who remains a client, when people come to you for your products and services, and when and how they're most likely to convert from a lead to a client, then you can refine your sales efforts to match what you know about selling—and make the dollars you invest into sales pay off.

More info on sales intelligence for your FinServ business

If you want to learn more about sales intelligence and how it can help your financial services business grow, here are some helpful articles to check out.

- • How and Why Sales Intelligence Will Help You Close More Deals

- • Sales Intelligence: What to Expect When You're Prospecting

- • The Rise of Customer Intelligence in Financial Services

Alternatively, if you feel like you want a more specific idea about how sales intelligence can be used to help guide your financial services business, and get a more personalized look at different strategies for increasing revenue, reach out to us at Learners.ai today. We can help you master RevOps, data-driven sales, and data-driven marketing so your company is working seamlessly to make customers happy and grow, year after year.